Get a free assessment of your case or a second opinion from CORI

Toronto-Dominion Centre - 66 Wellington Street West, Toronto, ON M5K 1A2, Canada. td.com

Bentall Centre - 505 Burrard St, Vancouver, BC V7X 1M5

The information you provide is protected under the Personal Information Protection and Electronic Documents Act (PIPEDA, S.C. 2000, c. 5).

Contact the nearest CORI office to inquire about the possibility of recovering funds lost due to fraud

Get tailored legal guidance or step-by-step self-help instructions - whichever fits your case best.

CORI’s achievements in asset and cryptocurrency recovery are recognized by the media.

Recover lost funds and crypto the right way — with CORI's expert-led consultations and ready solutions.

Find out about the next meeting in your city

Get Details

"CORI helped clients recover over CAD 78 million in H1 2025, according to the Canadian Anti-Fraud Centre (CAFC). In 2024, Canadians reported losses of over CAD 390 million to investment fraud, with only a small fraction formally registered"

CORI was established in partnership with private and public organizations to assist citizens affected by digital and investment fraud.

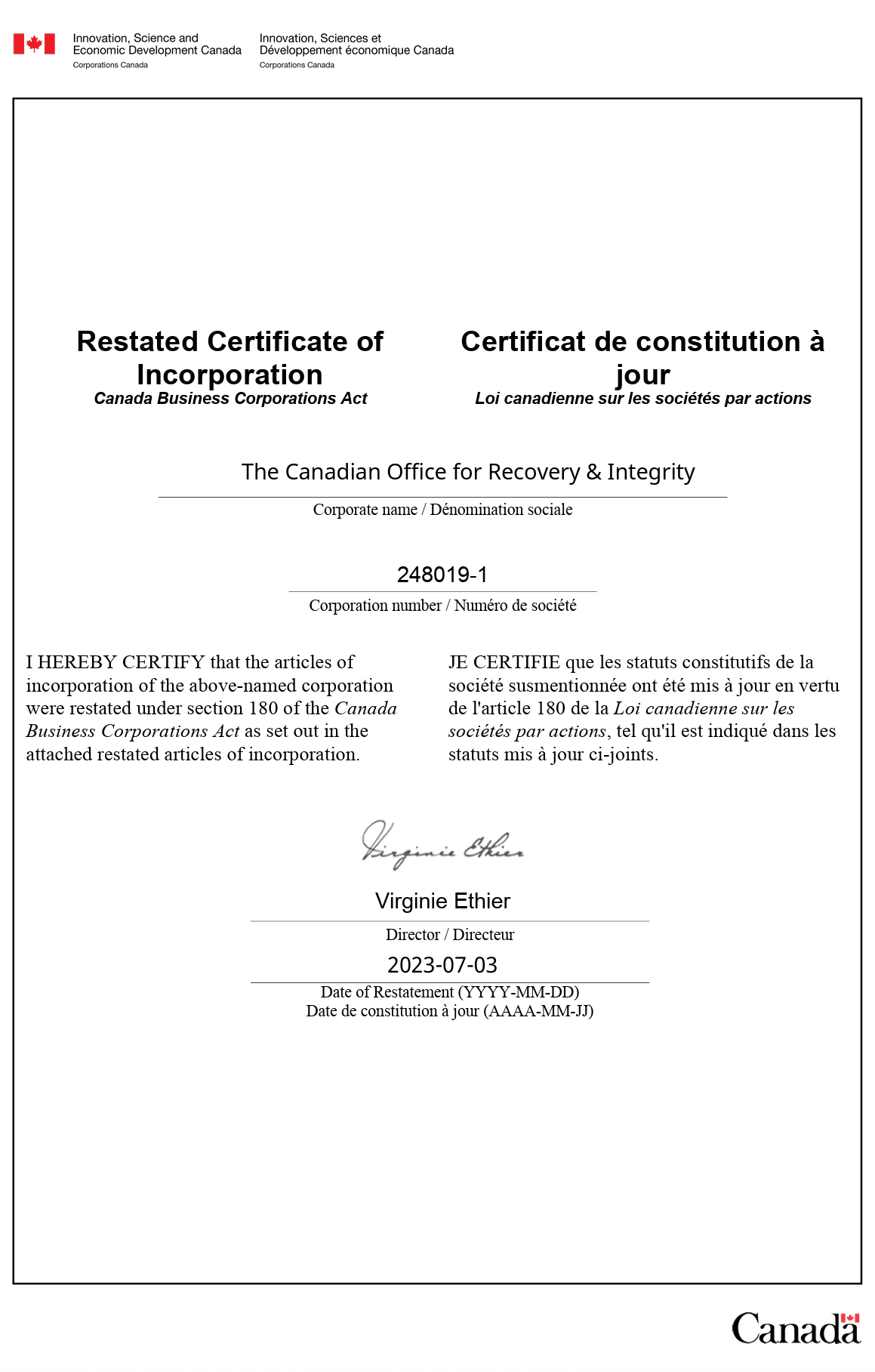

The organization operates under the Canada Business Corporations Act (R.S.C., 1985, c. C-44) and in alignment with the Government of Canada's 2030 Sustainable Development Strategy, supporting federal objectives in combating digital fraud.

Through collaboration with provincial and federal authorities, CORI plays a key role in protecting Canadians from online investment scams, ensuring accessible and effective financial recovery nationwide.

Toronto-Dominion Centre - 66 Wellington Street West, Toronto, ON M5K 1A2, Canada. td.com

Bentall Centre - 505 Burrard St, Vancouver, BC V7X 1M5

We assist Canadians who lost money through cryptocurrency investments, forex and contracts for difference (CFDs), binary options, fake investment sites, "AI trading" bots, and similar online investment offers.

Common situations include blocked withdrawals, frozen balances, unresponsive brokers/exchanges, or requests to pay "verification"/"final" fees.

Online-investment cases are rarely contained in one country: a platform may sit in one jurisdiction, the payment processor/bank in another, and the assets move across several chains and exchanges. That's why recovery efforts must cross borders.

CORI works through a vetted partner network of law firms and investigators in key jurisdictions (U.S., U.K., EU, UAE, Switzerland, etc.). This lets us coordinate local filings, evidence requests, and court applications where the counterparties or assets are located, while blockchain tracing and case management in Canada tie everything together.

CORI operates through a comprehensive recovery process that combines fund tracing, legal coordination, and international enforcement support.

We track digital assets via blockchain analysis, work with law enforcement and financial institutions, and help secure asset freezes when needed.

Our team also prepares evidence-based reports, files regulatory complaints, and negotiates with banks, payment providers, and crypto exchanges to maximize recovery chances — including cross-border and arbitration cases when direct restitution isn't possible.

We act strictly under Canadian law and only after signing a clear service agreement that sets out scope, timelines, fees, and data use.

There are no hidden terms—all steps are approved with you in advance. We start with intake and evidence collection (payments, messages, platform data). Based on this information we run a feasibility assessment and confirm whether a legal or investigative pathway exists. If prospects are weak, we say so transparently; if viable, we proceed according to the agreed plan. All work is done with your consent.

We run a dual-track model — legal remedies + advanced investigations — so evidence turns into action when the law allows it.

Legal toolkit: Court applications such as disclosure/Norwich orders to obtain data from exchanges, banks, and payment providers. Injunctions / asset-freeze (Mareva-style) where available, preservation orders, and takedown requests. Coordinated cross-border filings through our vetted partner counsel when assets or operators sit outside Canada.

Web3 & forensic stack: On-chain tracing across BTC/ETH and multi-chain assets; cluster analysis, smart-contract attribution, bridge/mixer pathing, and exchange risk scoring. Cross-border payment reconstruction (cards, wires, PSPs) to map fiat on-/off-ramps.

AI-assisted intelligence: Entity resolution and link analysis to connect wallets, accounts, devices, and merchants. Anomaly detection and deep-/open-source intelligence to surface operators and associates.

Victims of financial fraud who have not received protection or restitution through law enforcement may still pursue compensation through legal mechanisms available under Canadian law.

This right is supported by provisions of the Canadian Criminal Code, the Canadian Victims Bill of Rights (S.C. 2015, c. 13), and corresponding provincial victim compensation programs.

Depending on the circumstances, compensation may be provided through provincial financial assistance programs for victims of crime or from seized and forfeited assets held by authorities under the Seized Property Management Act.

The availability and type of compensation depend on several factors, including: the jurisdiction where the offence occurred; the victim's residency and citizenship; whether a criminal or civil case has been initiated; the level of documentation supporting the loss and fraud circumstances; and the legal status of assets subject to recovery or restitution.

There's no way to guarantee success or a fixed timeline in advance. After we review your documents, we'll give a realistic estimate.

Typical timelines: payment-rail disputes and chargebacks often resolve within 30–90 days; cross-border or court matters usually take longer.

Fees: our percentage and terms are set out upfront in the service agreement and sent to you for approval before any work begins. No hidden fees. If third-party costs (e.g., court or filing fees) are required, we'll outline them in advance.

All client information is processed, stored, and protected in accordance with Canadian privacy laws (PIPEDA and applicable provincial acts).

Fill out the online form and our support centre will get back to you — or call us directly.